An Average Retirement? Not For Me!

- 1.An Average Retirement? Not For Me!

Author: Daniel Brown

In the last two months, I have travelled in five different countries. Whilst enjoying some much-deserved downtime – education at our yearly conference, being dragged around the tourist attractions and enjoying the tropical weather, I’ve also been considering what the population of each country aspires to when it comes to finances and their concept of retirement.

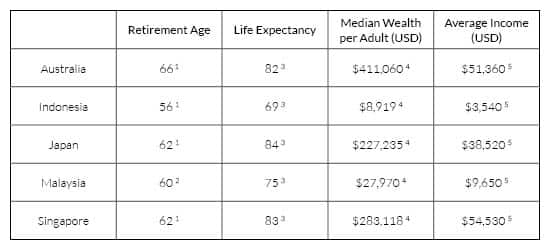

How average retirement looks around the world

This is the picture in each country I’ve visited:

We know that between the ages of 65 and 75 we spend the largest portion of our income on lifestyle and travel (27% of disposable income), compared to over the age of 80 when we spend only 11%. As an advice business, we need to conceptualise what each person’s ideal lifestyle will be in those initial retirement years to maximise the opportunity for enjoyment without financial constraints.

Achieving our own ideal retirement

I’m now in my sixteenth year of providing Financial Planning. One of the best things about building long-term partnerships with clients is that I’ve also come to understand the influence they have had on my desire to be above average, including the desire to grow my personal wealth and retire early. In the end it’s quite simple – we have every opportunity to build our ideal retirement, it just comes down to what are we prepared to do.

We have a passionate team of retirement specialists, committed to being the best we can be and following our clients into our own ideal retirement. After all, how can we not be influenced by who we spend our time with? Those wanting to build, enjoy and leave a legacy by passing on their wealth to future generations.

I enjoy a lifestyle of travel, time with family and friends and choose when I work and how I spend my money, without thinking if or how I can afford it. Perhaps the clients who have achieved this lifestyle have influenced my beliefs, or maybe it’s my constant desire to be above average at everything I do.

All this down time has got me asking myself the following questions:

- What do I want?

- What can I do to make sure I’m above average?

- How can I teach my children the same values?

- What am I prepared to do to make sure my retirement is planned and implemented the same as my clients?

It’s not just about money – it could be lifestyle, passion, education, but I don’t want to be average.

I’m more passionate than ever about what 2019 and beyond has instore and I’m going to make sure I enjoy the journey ahead. I recognise that hard work, discipline and continued learning will give me every opportunity to succeed at being above average.

At Central Coast Financial Planning Group, our team of Financial Advisers are passionate about working with like-minded clients. We understand that we can achieve mutually beneficial relationships if we focus on helping clients to create a higher than average financial position, enabling them to enjoy their ideal retirement.

If you also want your future to be above average, it’s time to see our Financial Planning specialists based in the Central Coast and Newcastle. Please book an appointment here or call our office to make an enquiry.

World economic data sourced from:

- https://www.schroders.com/en/insights/economics/world-pension-ages-on-the-rise-when-will-you-retire/

- https://tradingeconomics.com/malaysia/retirement-age-men

- https://data.worldbank.org/indicator/sp.dyn.le00.in

- Credit Suisse Research Institute Global Wealth Databook 2018

- https://www.worlddata.info/average-income.php

DJIB Investments Pty Ltd T/A Central Coast Financial Planning Group is a Corporate Authorised Representative of RI Advice Group Pty Ltd, ABN 23 001 774 125 AFSL 238429. This editorial does not consider your personal circumstances and is general advice only. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information, please contact our office to opt out. The views expressed in this publication are solely those of the author; they are not reflective or indicative of Licensee’s position and are not to be attributed to the Licensee. They cannot be reproduced in any form without the express written consent of the author.