6 Retirement Investment Strategies You Need to Know

Many people look forward to enjoying their retirement. However, to ensure you end up with a comfortable and worry-free lifestyle after retiring, it is essential to plan it carefully. All retirement investment strategies come with their own list of pros and cons, so which one is right for you?

A crucial aspect of retirement planning is knowing the best options to invest your hard-earned money. The right investments can provide you with a steady income stream in your later years and help protect your money against inflation.

In this article, we’ll explore how much you would need to retire comfortably, examine various investment options for your retirement portfolio, and discuss the factors to consider when making investment decisions for your retirement.

How to Choose the Right Investments for Retirement

Choosing where to invest your money for retirement involves careful consideration of your financial goals, risk tolerance, time horizon, and investment preferences.

Here are some steps to help you make informed decisions:

- Assess your current financial position:

Before investing your money, take a closer look at the state of your finances. Evaluate your income, expenses, assets, liabilities, and other financial obligations. Can you afford to invest, and how much? Are there any areas that would need to be improved or adjusted so you can invest? How much of your income is consumed by expenses and repaying debt?

- Review your financial goals:

While you can’t predict the future, you can make projections such as your anticipated future expenses, desired lifestyle, and life expectancy. This will help you estimate how much money you would need to retire comfortably, as well as help you set clear objectives for your investments.

- Understand your risk tolerance:

Evaluate your comfort level with different levels of risk. If you’re risk-averse, you may want to focus on conservative investments like term deposits and bonds. Or if you have a higher risk tolerance, shares and REITs might be preferred options for you.

- Consider your time horizon:

The length of time you have until retirement will influence your present investment choices. Longer time horizons allow you to make aggressive investments, while shorter time horizons may require you to take a more conservative approach.

- Research investment options:

Familiarise yourself with different investment options, including their potential returns, risks, fees, and tax implications. This will help you make more informed decisions about where to invest your money.

- Diversify your investments:

Diversification helps you reduce overall risk and enhances potential returns. Allocate your investments across various asset classes, such as shares, bonds, cash investments, and property, to create a balanced portfolio.

- Stay informed and adapt:

Regularly review your investments and stay up-to-date on market conditions and economic trends. Note that your circumstances and your goals, as well as overall market conditions, may change down the road, so be prepared to adjust your investment strategy as needed.

- Consult a financial adviser:

If you’re unsure about your investment choices or need guidance on creating a comprehensive retirement plan, consider consulting a financial adviser. They can help you assess your financial situation, identify suitable investment options, and develop a tailored strategy for your retirement.

How Much Do You Need to Retire Comfortably?

Ask different people this question, and you’ll get different answers. How much money you would need to retire comfortably depends on several factors, such as your current and desired lifestyle, your income and expenses at present, inflation, and how long you expect to live.

A helpful benchmark is the Retirement Standard published by the Association of Superannuation Funds of Australia (ASFA). Drawing from research and surveys of current retirees’ expenses and living costs, the standard is updated quarterly to account for shifts in prices and consumer behavior.

The ASFA defines as ‘comfortable’ a retirement lifestyle that allows retirees to “enjoy a good standard of living, including private health insurance, a reasonable car, household goods and holiday travel”.

As of December 2022, the ASFA recommends the following household budgets for healthy, home-owning retirees aged 65-84 and 84-above, to live comfortably:

A modest retirement lifestyle, on the other hand, covers only the essential expenses, such as food, clothing, transportation, and utilities, and is largely supported by the Age Pension.

As of December 2022, the ASFA recommends the following household budgets for healthy, home-owning retirees aged 65-84 and 84-above, to live modestly:

To achieve these income levels, consider factors like your retirement age, life expectancy, and investment returns, as well as other sources of income like government pensions or part-time work.

Retirement Investment Strategies: What Are Your Options?

A variety of investment options are available to help you build a retirement portfolio that matches your needs and risk tolerance. Here are some popular choices for Australian investors:

Shares, also known as stocks or equities, represent partial ownership in a company. As a retirement investment strategy in Australia, investing in shares can be a way to potentially grow your wealth over the long term. This growth can be achieved through capital gains (increasing share prices) and dividends (payments made by the company to its shareholders).

Some potential benefits of investing in shares as part of a retirement strategy in Australia can include:

- Diversification: Australian shares can be purchased individually or through managed funds, exchange-traded funds (ETFs), or by investing in superannuation funds that have exposure to the Australian share market. Consider including shares in your retirement portfolio to help diversify your investments and reduce the overall risk of your portfolio.

- Long-term growth potential: Historically, shares have offered higher returns compared to other asset classes like cash and fixed interest over the long term. However, keep in mind that past performance is not indicative of future performance, and share prices can be volatile.

- Dividend income: Some Australian companies pay dividends to their shareholders. These dividends can be an additional source of income during your retirement years.

- Tax advantages: Investing in shares through your superannuation fund may provide tax advantages, as super funds generally pay a lower tax rate on investment earnings than individuals do outside of super. Also, in Australia, a unique tax benefit called franking credits may also be available to eligible shareholders, which can help reduce your tax liability.

Keep in mind that investing in shares also involves risks. Share prices can be volatile and may fluctuate due to various factors, such as market conditions, economic news, and company performance. It’s essential to understand your risk tolerance and investment time horizon before investing in shares for your retirement.

Term Deposits

Term deposits are a popular retirement investment strategy option in Australia for individuals looking to generate stable income and preserve their capital. They are offered by banks, credit unions, and other financial institutions. When you invest in a term deposit, you agree to deposit a sum of money for a fixed term, usually ranging from one month to several years, at a predetermined interest rate.

Some key aspects of term deposits as a retirement investment strategy in Australia include:

- Low risk: Term deposits are considered low-risk investments because they are offered by regulated financial institutions and are backed by the Australian government, up to a certain amount (the Financial Claims Scheme provides protection for deposits up to AUD $250,000 per account holder, per institution). This makes them an attractive option for conservative investors, such as retirees looking to preserve their capital.

- Fixed interest rates: Term deposits offer fixed interest rates for the entire term, providing a predictable income stream. The interest rate is typically higher than a regular savings account, but lower than riskier investments such as shares or bonds.

- Diversification: Including term deposits in your retirement investment portfolio can help diversify your assets, reducing the overall risk of your investments.

- Flexibility: Term deposits offer a range of terms and interest rates, allowing you to choose the best option for your financial situation and goals. For example, you may opt for a shorter term if you anticipate needing access to your funds soon, or a longer term to lock in a higher interest rate.

- Accessibility: Term deposits are widely available through banks, credit unions, and other financial institutions in Australia. Some institutions also offer online platforms, making it easy to manage your investments.

Some downsides of term deposits for retirement include limited access to funds, with penalties for early withdrawal, and the risk of not keeping up with inflation. Also, they generally have lower returns than stocks or bonds, which may not be enough for a comfortable retirement.

Cash Investments

Cash investments are a conservative retirement investment approach to consider if you want less risk and to protect your money. They usually include assets like cash, term deposits, and high-interest savings accounts. While the returns may be lower than shares, bonds, or property, they offer more stability and easy access to your money. As an investor, you can use these investments as part of your overall retirement plan.

These are some key points to consider:

These are some key points to consider:

- Safety and low risk: Cash investments are considered low risk since they are less affected by market fluctuations and economic downturns. This can be particularly appealing for individuals nearing retirement or those who are risk-averse.

- Liquidity: These investments are usually highly liquid, meaning you can easily access your money when needed. This can be beneficial in case of unexpected expenses or emergencies.

- Lower returns: While cash investments are considered safe, their returns are typically lower than other investment types like shares or property. This can impact the growth potential of your retirement savings.

- Inflation: Inflation can erode the purchasing power of cash investments over time, so it’s important to consider the impact of inflation on your retirement savings.

When thinking about cash investments for retirement, remember they have some downsides. They usually offer lower returns compared to other options and may not keep up with inflation, which can make it harder to grow your savings and maintain your buying power over time.

Investment Bonds

Investment bonds are long-term investments provided by insurance companies or friendly societies in Australia. They can be a useful retirement investment strategy if you’re looking to diversify your investment portfolio, save for retirement, or plan for future financial needs.

Here are some key features of investment bonds:

- Tax-efficiency: Investment bonds are tax-effective since earnings within the bond are taxed at the company tax rate (currently 30%). If you hold them for at least 10 years, you won’t need to pay any additional personal income tax when you withdraw the proceeds.

- No contribution limits: Unlike superannuation, investment bonds don’t have contribution limits or caps. This makes them suitable if you want to invest a large amount or make regular contributions without worrying about going over annual superannuation caps.

- Flexibility: Investment bonds offer various investment options to suit different risk levels and investment goals. You can choose from different asset classes, like shares, fixed interest, property, and cash.

- Easy withdrawal: Investment bonds don’t have strict withdrawal restrictions, so you can access your funds if necessary, although there might be tax implications.

- Estate planning benefits: Investment bonds can be used for estate planning, as they let you nominate beneficiaries who will receive the bond proceeds tax-free when you pass away.

- Simplicity: Investment bonds have a straightforward structure, making them easy to understand and manage.

However, it’s important to keep in mind that investment bonds might not be the right fit for everyone’s needs or financial situations. Assess your personal goals, risk tolerance, and investment horizon before deciding if investment bonds are suitable for your retirement strategy.

Annuities

Annuities are a retirement investment strategy that gives you a steady income during retirement. Life insurance companies and other financial institutions in Australia offer annuities. They can be purchased with a lump sum, multiple payments, or a combination of personal savings and superannuation funds.

There are two main types of annuities in Australia:

- Fixed annuities: These give you a guaranteed income for a set period or for the rest of your life. The income from a fixed annuity is usually decided when you buy it and doesn’t change over time.

- Variable annuities: These let you invest in various assets, like shares or bonds, which could make your income go up over time. The income from a variable annuity depends on market changes, and you take on the investment risk.

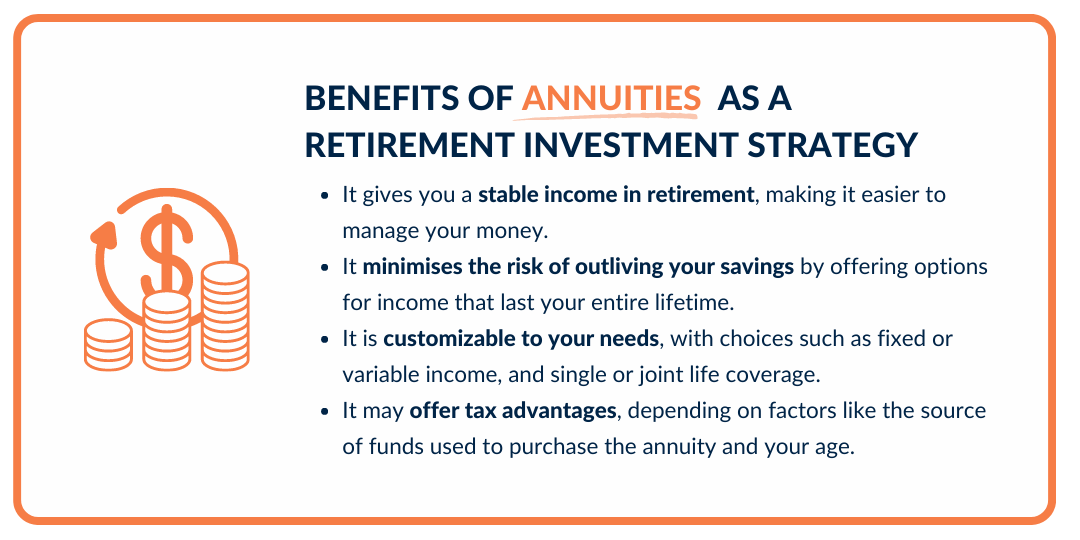

Investing in annuities could be a good choice, as they provide the following benefits:

- Steady income: Annuities provide a regular, secure stream of income during retirement, helping you manage your finances with predictability.

- Minimises longevity risk: Annuities help mitigate the risk of outliving your savings by offering lifetime income options.

- Customizable options: Annuities can be tailored to your specific needs, with choices like fixed or variable income, single or joint life coverage, and immediate or deferred payments.

- Tax advantages: Annuity income may have favourable tax treatment, depending on factors such as the source of funds used to purchase the annuity and your age.

One of the downsides of annuities is limited flexibility, as you cannot easily withdraw funds once invested. As a conservative type of investment, annuities also offer potential returns lower than other investment options.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) can be another retirement investment strategy in Australia, giving you a chance to invest in a variety of income-generating real estate properties.

A REIT is a company that owns, runs, or finances income-producing real estate. In Australia, REITs are also called Australian Real Estate Investment Trusts (A-REITs) or Listed Property Trusts (LPTs). They’re traded on the Australian Securities Exchange (ASX) and can be bought and sold like stocks.

Some key features of REITs as a retirement investment strategy in Australia include:

- Diversification: REITs invest in different kinds of properties, like commercial, retail, residential, and industrial. This can help lower risk in your overall investment portfolio.

- Income generation: REITs have to give most of their taxable income to shareholders as dividends. This makes them appealing to retirees who want regular income.

- Liquidity: Since REITs are traded on the ASX, you can easily buy and sell shares when you need to.

- Professional management: REITs are managed by a team of experts who handle choosing, buying, and managing properties. This gives you access to real estate market expertise.

- Inflation hedge: Real estate investments can help protect against inflation, as property values and rental income often go up with inflation over time.

However, there are risks associated with investing in REITs, like market volatility, changes in interest rates, and risks in the property market. Also, dividend income from REITs is usually taxed at your marginal tax rate, which might be a concern if you are a retiree in a higher tax bracket.

Factors to Consider When Making Retirement Investment Decisions

To recap, you have many options for growing your retirement money. Each has its own benefits and downsides, and may or may not be suitable for your financial needs, so it would be wise to spend some time on research and self-assessment. Remember, you don’t have to choose only one of these investments, you can invest in as many of them as you wish when constructing your retirement portfolio.

Remember, when selecting investments for your retirement portfolio, consider the following factors:

- Risk Tolerance: Understand your appetite for risk and choose investments that align with your risk profile.

- Time Horizon: The length of time you have until retirement will influence your investment choices, as longer time horizons allow for more aggressive investments.

- Diversification: A well-diversified portfolio reduces overall risk by spreading investments across different asset classes.

- Fees and Charges: Consider the fees associated with various investment options, as they can significantly impact your overall returns.

- Tax Implications: Understand the tax implications of different investment options and consider strategies to minimise your tax liability.

- Inflation Protection: Choose investments that can help protect your retirement savings against the eroding effects of inflation.

- Liquidity: Consider how easily you can access your investments in case of an emergency or a change in circumstances.

Ready to Build an Investment Portfolio?

Choosing the right retirement investments is important when creating a comfortable and secure future for yourself. Think about your risk level, how long you’ll invest, and what you like to create a varied portfolio for your goals. Also, consider also talking to an experienced financial adviser, who can help you make good choices and design an investment plan that is most suitable for your situation.

While investing can seem complicated and time-consuming, it doesn’t have to be that way with knowledge and expert guidance. Whether you’re young or old, it’s never too late to start investing for your future.

Need investment advice? Central Coast Financial Planning Group helps you tailor your investment plan and build your portfolio. Our financial advice team can help you establish direction for your investments to achieve your financial and lifestyle goals.

Call us or book online to secure your consultation today!

REFERENCES:

- https://www.superannuation.asn.au/resources/retirement-standard

- https://moneysmart.gov.au/glossary/franking-credit

- https://www.apra.gov.au/types-of-accounts-covered-under-financial-claims-scheme

DISCLAIMER: The views expressed in this publication are solely those of the author; they are not reflective or indicative of RI Advice Group’s position and are not to be attributed to RI Advice Group. They cannot be reproduced in any form without the express written consent of the author. This information (including taxation) is general in nature and does not consider your individual circumstances or needs. Do not act until you seek professional advice. Newcastle Financial Planning Group, Central Coast Financial Planning Group, Sydney Wealth Advisers, Coastal Advice Port Macquarie and Coastal Advice Ballina Byron are subsidiaries of Coastal Advice Group Pty Ltd which is a Corporate Authorised Representative of RI Advice Group Pty Ltd, ABN 23 001 774 125 AFSL 238429.